Introduction

In a time where technology is constantly changing our lives, even long-standing companies like pawn shops are changing. Pawn shops are employing internet platforms in addition to their traditional brick and mortar sites as part of their evolution to fulfill the needs of contemporary consumers. For pawnbrokers as well as clients, this change makes things easier to obtain and expands opportunities.

Traditional Origins:

Historically, pawn shops have been vital resources for anyone in need of quick access to money. In the past, debtors would pledge valuable items as collateral for short-term loans. These items included jewelry, gadgets, collectibles, and musical instruments. The process was straightforward: after getting a loan based on the item’s appraised value, consumers may keep the item as long as they returned the loan with interest within the specified period.

Transitioning too Digital:

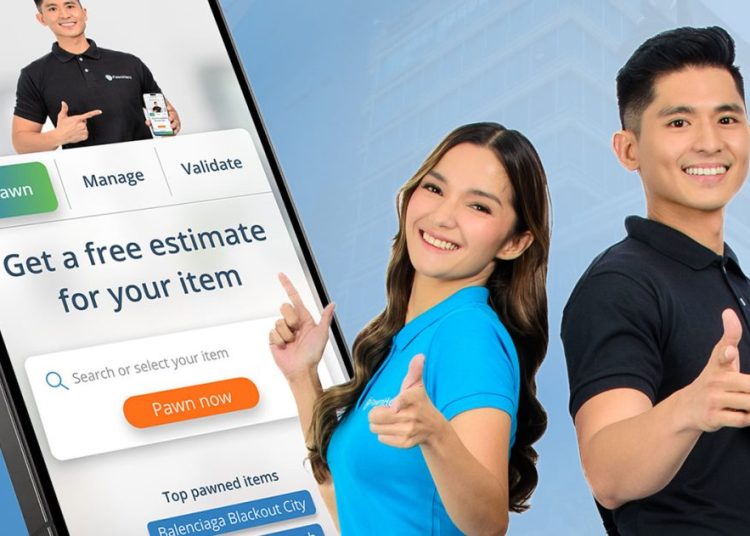

With the arrival of digital technology, the pawn industry has experienced a transformation that has ushered in a new era of simplicity and accessibility. As internet platforms have grown, pawnbrokers may now reach a wider audience and speed up the financing process. Instead of needing to visit a physical store, customers may now submit loan requests and item specifications online, saving time throughout the appraisal and approval process.

Enhanced Customer Experience:

Online loan applications, virtual assessments, and secure payment options are just a few of the advantages that digital pawn shops offer to make their customers’ lives easier. Clients no longer need to exert themselves to visit a physical location in order to conveniently obtain money thanks to this modification. Furthermore, online platforms often provide transparency regarding loan terms and item evaluation, allowing users to make informed decisions.

Expanding the Market’s Capacity

Pawn shops can use online platforms to expand their customer base and reach new areas. Pawnbrokers operating online can assist customers from a range of backgrounds and provide their services outside of their local area. Through providing financial assistance to underrepresented groups, this expanded reach fosters inclusivity and expands commercial opportunities.

Safety and Mitigation of Risks:

Digital pawn shops put security first in order to protect lenders and borrowers. Strong encryption techniques safeguard private data and guarantee transaction secrecy. In order to minimize fraud, digital platforms also use strict verification procedures, which reduces the risks involved in online lending.

Novel Approaches to Asset Appraisal:

Technological developments have completely changed the evaluation process by allowing pawnbrokers to determine the exact value of items. Using advanced algorithms and market data, digital platforms can be used to get accurate appraisals in real-time. This guarantees that consumers will receive reasonable loan offers and lessens the possibility that pawnbrokers may overvalue their items.

Adapting to Changing Trends:

Pawn shops have changed over time in response to advancements in technology, as well as shifting consumer preferences and industry trends. Digital pawnbrokers are always enhancing their services based on feedback from customers and new developments in the industry. In a field that moves swiftly, their capacity to quickly adapt lets them fulfill shifting needs and stay relevant.

Sustainability and Environmental Impact:

Digital pawn shops contribute to sustainability efforts by reducing the environmental impact of traditional lending practices. Online platforms lessen the need for physical shops and paper documentation, which promotes ecologically friendly business operations. Furthermore, the necessity for traditional banking services—which often require a lot of paperwork and resources—is reduced by the digitization of pawn transactions.

Conclusion

The shift of a local pawn shop from physical shop to online platforms signifies a significant shift in the market dynamics. By using technology, pawnbrokers may enhance customer experiences, draw in a larger clientele, lower risks, and promote sustainability. As the digital revolution advances, pawn shops are well-positioned to address the financial needs of people everywhere by ensuring accessibility, transparency, and convenience at every step.